BREEAM enables clients to engage with Environmental Social Governance

BREEAM enables clients to engage with ESG to drive better outcomes. The most recent panel of leading industry experts met in May, 2021 to discuss ESG goals.

Environmental Social Governance (ESG) is a vital consideration when making real estate investment decisions. Engagement with ESG will play an important role in the response to environmental and social threats, as well as meeting an increasing demand from tenants to live and work in buildings that are committed to reducing those threats. In a study carried out by Eurocell, 49% of respondents said they would be more likely to buy or rent an eco-conscious home.

BREEAM enables clients to engage with ESG to drive better outcomes. The most recent panel of leading industry experts met in May, 2021 to discuss ESG goals. The meeting included insights from:

- Dan Winters, Head of Americas, GRESB

- Derk Welling, Senior Responsible Investment & Governance Specialist, APG

- Katherine Sherwin, Global Head of Real Assets Sustainable Investing, Blackrock

- Roger Baumann, COO and Head Product Development Global Real Estate, Zurich Insurance

- Richard Hamilton-Grey, Head of Sustainability, Nuveen

- Aleksandra Njagulj, Global Head of ESG, DWS

- Etienne Cadestin, Founder and Chief Executive Officer, Longevity Partners

- Sam Stockdale, Vice President, Environment and Sustainability, Link Industrial Properties

- Anne Peck, Vice President & Head of Architecture & Engineering, AEW Capital Management

Creating better spaces for tenants, as well as engaging tenants in discussions around improving their health and wellbeing are vital for the ‘social’ branch of ESG. As I’ve listened to the discussion, 3 key challenges stood out:

1. Meeting residential tenant expectations

2. Aligning with tenant values

3. Engaging with harder to reach industrial tenants in triple lease assets

Meeting tenant expectations.

The growing number of asset investors now use rating systems to drive sustainable performance and measure the effectiveness of tenant engagement. Embedding ESG principles into asset management, driving tenant engagement and property value are linked. APG and Blackrock have both identified that the benefits that come from rating systems drive property value. They have decided to implement BREEAM into their ESG strategies to reap the financial benefits. So did Zurich Insurance, another business that understood that certification increases profits and value in real estate. All 3 businesses have adopted BREEAM to provide economic signalling to the quality of their portfolios.

“The S aspect of ESG folded into a certification scheme that already looks at lots of sustainability issues is the way forward” – Katherine Sherwin, Blackrock

What became evident is that BREEAM certification shows to the tenants that asset managers are committed to engaging with environmental and social issues. It is becoming increasingly important that health and wellbeing issues are considered when implementing an ESG strategy, particularly when trying to improve tenant relationships. This is because in the USA and Europe we spend around 90% of our time indoors, so it is vital that buildings are designed with the comfort of users in mind.

Interestingly, all panellists spoke about BREEAM as a holistic certification tool that addresses both health and wellbeing issues, and a broad range of environmental issues. This makes BREEAM appealing to real estate managers and investors as it considers the occupants of the buildings, rather than how the building performs as an isolated asset. Blackrock has utilised BREEAM for this exact reason – it allowed them to approach tenant relationships by implementing a holistic management system that integrates both the social aspects of ESG, and environmental.

Aligning with tenant values.

“It is important to get in the room with the tenants to have a strong conversation”- Aleksandra Njagulj, CBRE

Education and open dialogue are crucial for alignment with tenant values. In a complimentary method to BlackRock, CBRE approach tenant relationships not only with BREEAM but also by involving the tenants in open discussions about asset management. These conversations hope to get tenants engaged and excited about the benefits of BREEAM, from improved air quality, to reduced costs, to improved recycling. It was good to hear that Longevity Partners also use BREEAM to demonstrate to tenants and investors that they understand their needs.

“If you have a global or national portfolio and you want something affordable to demonstrate to investors and tenants that you have a good understanding of their needs, it’s a fantastic tool”-Etienne Cadestin, Longevity Partners

Engaging with harder to reach industrial tenants in triple lease assets

What about innovative ways to manage industrial buildings? Industrial buildings present a unique challenge for numerous reasons, including complexity in managing assets in a triple-net lease.

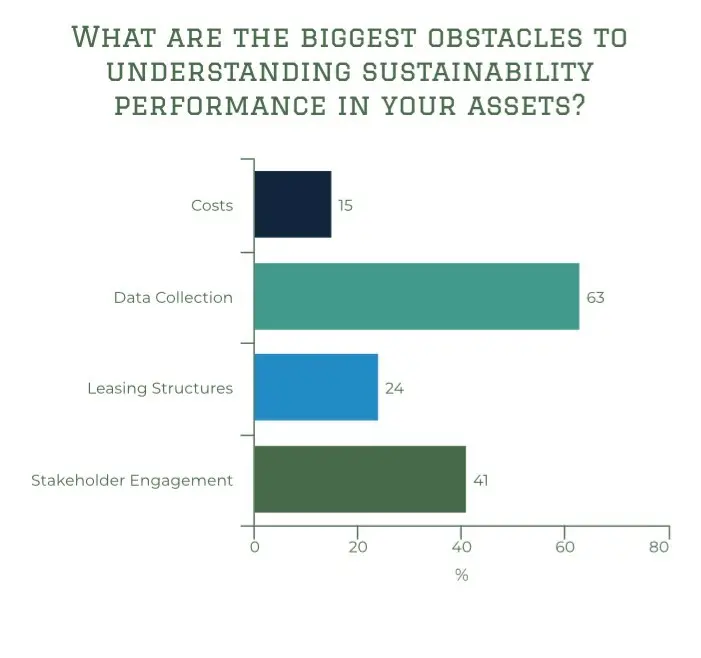

What is apparent is that gathering building performance data is one of the biggest challenges for the American industrial real estate market. 63% of the audience agreed that ‘data collection’ is the biggest obstacle to understanding sustainability performance in their assets. But why does it present such a barrier?

- Tenants don’t realise the importance of gathering building performance data.

- Tenants are not aware of who the asset managers are.

- Tenants don’t want to share the performance data.

“BREEAM certification can be used as a tool to engage” – Breana Wheeler, BREEAM USA

However, there are ways overcome identified barriers. Link Industrial Properties and AEW Capital management shared that they implement operational and management performance strategies to improve tenant relationships and gain the important building performance data. BREEAM supports this process by providing a consistent, yet flexible approach to sustainability management that reaps benefits for tenants and asset managers/owners.

“The key is to have sustainability management that provides consistency- BREEAM can provide this consistency but also has flexibility” – Sam Stockdale, Link Industrial Properties.

The discussion also gave an interesting insight into the misconception around BREEAM certifying triple-net lease assets. Just 25% of the listeners knew that BREEAM can address triple-net leases. There is a certainly a need to correct the misconception of the capabilities of BREEAM in the market, so education and communication are critically important moving forward.

As the focus on ESG and Net Zero intensifies, BREEAM is acknowledged as a crucial milestone on a path to more sustainable and healthier future. I was inspired by the practical advice and best practices shared in the discussion and look forward to more success stories around the world.

Want to hear more from BREEAM? Sign up to our brand new newsletter to receive the latest built environment sustainability news from our world leading experts- https://www.breeam.com/

Keira Morgan – Market Analysis & Sustainability Content Creator.

Share

BREEAM USA news

Browse other BREEAM USA news

BREEAM USA’s 2025 Review: Scaling Impact Across Key Markets

Data Center Market Breakdown: Sustainability Trends and Outlook

Retail Market Breakdown: Sustainability Trends and Outlook

Championing Biodiversity for Real Estate

Key Takeaways from Climate Week NYC 2024

Get in touch

Contact us now or call us on +14152981619 if you would like to talk to our team about how BREEAM can support you.

Return to BREEAM USA Homepage