A response to the spring statement 2022 - BRE Group

What does the spring statement mean for the built environment?

On Wednesday 23 March 2022, Chancellor of the Exchequer Rishi Sunak MP issued his 2022 Spring Statement, setting out the state of the UK’s economy amidst rising inflation and a cost of living crisis.

This year’s Statement announced a series of measures intended to ease the effects of rising costs for households, including:

- A 5p reduction on fuel duty until March 2023.

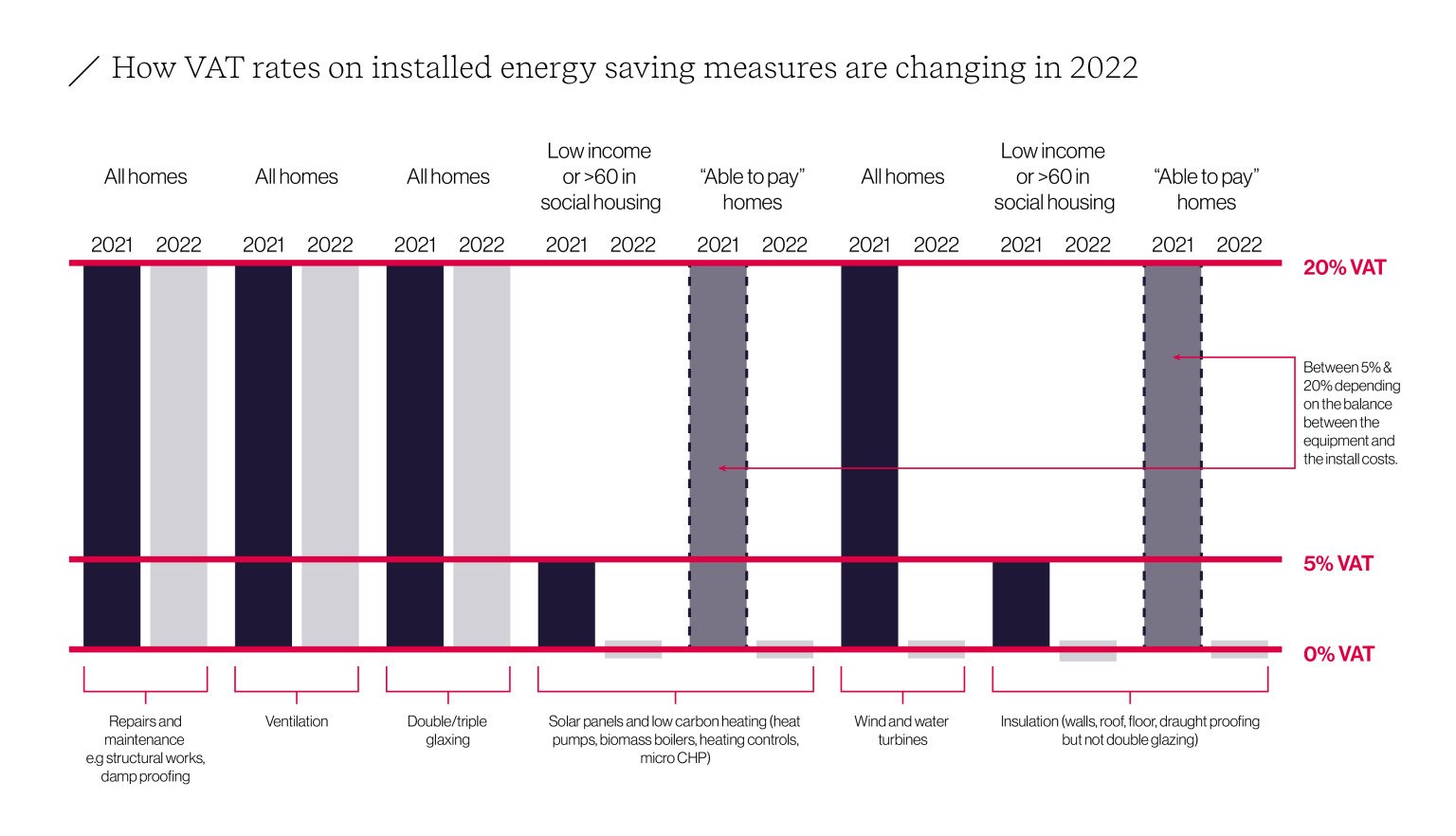

- Cutting VAT to 0% on energy saving materials for the next five years.

- Doubling the Household Support Fund to £1bn from April 2022.

- Raising the National Insurance threshold from July 2022, to £12,570 a year.

While the Statement contained no mentions of net zero it did offer a time-limited zero rate of VAT for the installation of certain types of energy saving materials (ESMs). This will commence in April 2022, lasting the next five years, before reverting to the current 5% reduced rate of VAT.

The Government notes that this “reverses Court of Justice of the European Union derived legislative changes introduced in 2019, which narrowed the scope of previous relief for installations in residential accommodation in Great Britain.”

This VAT reduction is welcome, with energy efficient homes key to improving health and wellbeing, mitigating rising living costs and, of course, reaching net zero. However, it is also limited.

The ESMs covered by the new 0% rate include: insulation, draught stripping, central heating and hot water system controls, solar panels, ground and air source heat pumps, and biomass boilers. Wind and water turbines, which were removed in the 2019 changes, will also be reincluded. This does not, however, include key preparatory and ancillary works – notably structural works, damp treatments and ventilation.

These works will be essential if retrofit is to be delivered effectively and in line with whole house principles. Failure to do so risks severe consequences – insulation installed on structurally unsound, damp homes is ineffective and can damage the property, and without fabric first improvements, heat pumps will not work as effectively as they should. The failure of previous schemes has dented consumer and business confidence in green measures, and we can’t afford any further setbacks if we are to reach net zero by 2050.

While the reduction is positive, it must be situated within a national retrofit strategy which sets out clear, long-term plans to upgrade the UK’s building stock. This strategy should include a wider 5% VAT reduction to home improvement works, as called for by BRE, the Construction Leadership Council, and others.

Thousands of skilled workers across the country will be needed to deliver this, and we also need to see more detail on how the Government plans to fund and train them to do so. The Government’s plans to improve the operation of the apprenticeship levy is welcome. Greater flexibility in how businesses can access and use levy funds will help to build the skilled, innovative workforce we need to reach net zero.

For businesses, the Spring Statement brought forward a planned business rate exemption for on-site renewables and low-carbon heat networks. While this will make an important contribution towards the decarbonisation of non-domestic buildings, it is concerning that there is no support for fabric energy efficiency improvements in business buildings, either via business rates or alternative mechanisms.

Nevertheless, the Spring Statement contains positive announcements which will support households to decarbonise, and while it falls short of the retrofit strategy needed, it is a welcome first step.