Navigating the Carbon Risk Real Estate Monitor (CRREM) Tool For A Stronger Pathway to Net Zero - BRE Group

Navigating the Carbon Risk Real Estate Monitor (CRREM)

Following the latest webinar in the BREEAM US webinar series, "Pathways To Net Zero — CRREM and the Decarbonization of the Built Environment, our team received a number of questions submitted from attendees who were interested in learning more about The Carbon Risk Real Estate Monitor (CRREM), its benefits, and its global application and potential impact. As such, we have invited the architect of CRREM Prof. Dr. Sven Bienert to continue the discussion around CRREM. In the following guest post, Dr. Bienert addresses the concept of stranded assets, how CRREM will translate to the real estate industry in the US, and why continued investment in energy efficiency and conservation is an instrumental component for stronger Net Zero Carbon strategies.

On the concept of stranded assets

The term ‘stranding risk’ alludes to potential write-downs and devaluations due to direct climate change impacts and the transition to a ‘low-carbon economy’ — some of the current risks that could negatively affect properties with relatively high energy consumption and conventional energy sources include higher energy costs, stricter building regulations, and carbon taxes. These changing market expectations result in a faster economic obsolescence of real estate assets that no longer meet the new energy and technical requirements. These properties will also likely not meet future regulatory and efficiency standards regarding their carbon performance. These risks have the potential to amount to trillions of dollars in losses, resulting in a growing liability upon company leaders and an increasing fiduciary responsibility among fund managers. Long-term investments are most vulnerable to the risks of asset stranding and require increased attention to adequately manage those risks.

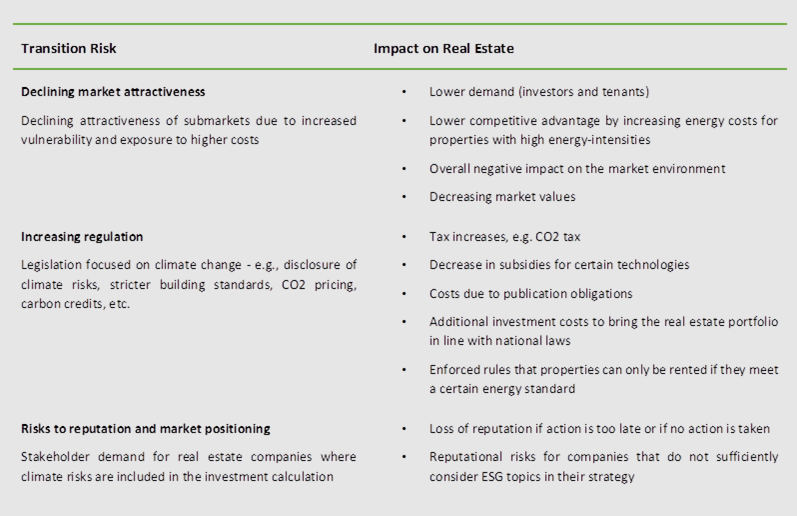

Table: Examples of transition risk and impact on Real Estate

On how CRREM will support the US real estate market to decarbonize

Noting that all human-produced GHG-emissions must reach “Net Zero” by 2050 for a sufficient chance at fighting our climate crisis, reliable, scientific and granular decarbonization pathways for participating countries and economic sectors – including real estate – are needed in order to provide clear guidance. Then, once this pathway is established, we must consider methods, standards, and software-based solutions that enable market participants to benchmark and align their property portfolios against the well-defined decarbonization requirements and trajectories over time.

The Carbon Risk Real Estate Monitor (CRREM) initiative offers guidance for all of the above-mentioned sub-areas addressed by the United Nations Environment Programme Finance Initiative (UNEP FI) and the Task Force on Climate-related Financial Disclosures (TCFD), which enables investors, asset managers, banks and other market participants to leverage resources for the structured decarbonization of their real estate portfolios. These resources are harmonized with all major international organizations globally. To maintain the integrity of this process and its results, it is important to maintain a focus on transparency, conducting in-depth analyses and detailed investigations that aid in avoiding greenwashing.

One of the biggest challenges in the reduction of GHG emissions results from the poor energy efficiency of existing buildings and still-too-low refurbishment rates in virtually all countries around the globe. The reduction of the global carbon footprint requires a significant increase of energetic retrofits in the existing property stock. The CRREM initiative’s main objective is to support and enable this necessary transition. The initiative aims at supporting the industry to tackle these risks and foster investments in energy efficiency.

CRREM supports the sustainable global financial system by encouraging adoption of the Paris-aligned decarbonization targets and collaboration on their implementation, and by fostering good governance and reporting standards that ensure integrity and accountability to avoid green-washing. CRREM reduces investor uncertainty and offers a viable basis for investment decision-making — taking into account stranding risks and strategic retrofit planning in order to meet forthcoming climate regulation and decarbonization requirements.

The initiative’s main objectives are to:

- Increase transparency regarding country and use-type specific decarbonization requirements in accordance with the Paris-Agreement and latest scientific evidence for real estate.

- Support real estate investors and asset managers in measuring and reducing their operational carbon footprint on the property and portfolio levels with software tools, new methods, and scientific reports.

- Support global harmonization of decarbonization initiatives within the real estate sector.

- Ensure higher awareness for transition risk within the real estate industry with various dissemination activities.CRREM has become the leading global initiative and source to establish operational carbon emission pathways for the real estate industry. The non-for-profit-initiative is supported by the EU commission, Laudes Foundation, GRESB Foundation, APG, PGGM, Norges Bank Investment Management (NBIM), GPIF, and Ivanhoé Cambridge. Further, to ensure a strong governance, two Committees consisting of leading experts and scientists were established to support and advise the work of the initiative. The “Global Scientific Committee” (GSC) is composed of carefully selected academic experts that have backgrounds in real estate and environmental sustainability across European, North American, and Asian markets. The “Global Investors Committee” (GIC) encompasses representatives of the leading global industry bodies as well as major investors, asset managers and IT companies – most of the participants also have a strong background in sustainability in addition to the real estate sector. The methodological process and functional specifications of CRREM resources, tools and metrics is regularly scrutinized by the Committee members.

CRREM resources are aligned and accepted by the leading international organizations and initiatives including TCFD, SBTi, PCAF, IIGCC, NZAOA, E-CORE, INREV, and ULI Greenprint, among others. In the US, CRREM’s partnership with SBTi requires that companies submitting targets to SBTi for target validation also comply with CRREM guidelines.

Why continued investment in energy efficiency and conservation is an instrumental component of a strong Net Zero Carbon strategy

For investors and asset managers, the need to have a well-defined and clear strategy to assess, quantify and mitigate the stranding risk of their portfolios will only become more relevant as time goes on. In order to achieve a Net Zero target that is compliant with the Paris Agreement, carbon risk mitigation strategies need to be aligned with corporate Environmental, Social and Governance (ESG) principles and define instruments and measurement standards to transparently track and monitor the success of risk mitigation actions, as well as cost-benefit trade-offs. Only the individual bottom-up assessment of each asset will enable owners to thoughtfully navigate and time strategic decisions for developments posing the threat of obsolescence (decisions to sell, buy, hold, upgrade, retrofit).

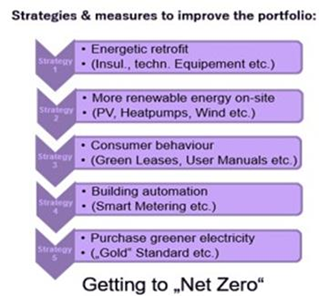

Table: Strategies & Measure to Getting to Net Zero

Stepping into action with CRREM

The CRREM decarbonization pathways are integrated in the CRREM-Tool, which enables market participants to ensure strategic planning, benchmarking, ongoing management, and controlling, while facilitating reporting requirements related to global ESG initiatives. After inputting specific information about particular assets, investors and lenders can use this tool to analyze real estate portfolios in a number of different ways, from alignment with Paris goals to identification of assets that are in danger of stranding to potential retrofit strategies. With major global investors, industry bodies and academics recommending the use of CRREM for the real estate sector, CRREM is now the standard for the real estate market’s Net Zero Carbon ambitions. CRREM is being integrated into the BREEAM platform to provide net zero trajectory insights utilizing the data that underpins asset certification, supporting asset owners to pursue certification, drive performance and report to investors on how their assets performance against the CRREM trajectory for their asset types.

BREEAM USA news

Browse other BREEAM USA news

BREEAM USA's 2023 year in review: geographic and sector expansion drive robust certification growth

Investing in tomorrow: Unpacking the economic upside of ESG with BREEAM and J.P. Morgan

BREEAM USA certifications grow by nearly 160% in 2022

BREEAM announces partnership with EPA’s ENERGY STAR® program

BREEAM USA experts on the pathway to carbon net zero in real estate

BREEAM USA takes part in GBES webinar on value of sustainable buildings

BREEAM USA experts discuss a sustainable future for data center assets

BREEAM amplifies its presence in the U.S. by expanding capabilities

Get in touch

Contact us now or call us on +14152981619 if you would like to talk to our team about how BREEAM can support you.

Return to BREEAM USA Homepage